Why receivables management is so important in the crisis

So far, there has been no marked increase in corporate insolvencies in the COVID19 crisis. However, experts such as the Leibniz Institute for Economic Research, Halle (IWH), expect that this will change no later than fall. With this is mind, is there anything you can do right now to limit the economic risk? The answer is: you can, if you focus on payment experiences, debt collection and creditworthiness information.

If there are signs a storm is brewing, the most important thing is to keep finances under control. This is easier to do for expenditure than for income, as it can be directly influenced. But what is the situation with regard to debtor transparency? This article provides an introduction to modern risk management and offers solutions to common challenges.

Securely assess payment behaviour and creditworthiness

In most companies, customers and the revenue that comes from them are the engine of economic success. If this starts to wobble, growth is endangered and risks increase. This correlation shows how closely sales and corporate success are linked. To keep the engine running smoothly, it is important to monitor the success factors—especially in these times of crisis.

A periodic look at payment behavior provides the first indications. Are there significant changes compared to previous months? And if so, do they only affect your company or do other suppliers also experience it? If anomalies are detected, effective risk reduction measures can be initiated, such as advance payments. One way of keeping an eye on payment behavior is to use data services such as those offered by Creditreform. They help identify potential need for action quickly and reliably. All relevant information is imported directly into the Microsoft Dynamics ERP system, which further increases transparency.

However, payment behavior alone says little about actual creditworthiness. The Creditreform creditworthiness index lets you assess this quickly and easily. A variety of data is used for this, weighted according to relevance and consolidated to a total value. The methodology for calculating the creditworthiness index is being constantly developed so that warning signals can be seen even if payment behavior is “still” good. Integrating this check into the process flow before accepting the order is recommended for larger orders in particular—ideally via an automated workflow that activates the check and documents its release.

Defaults can be avoided

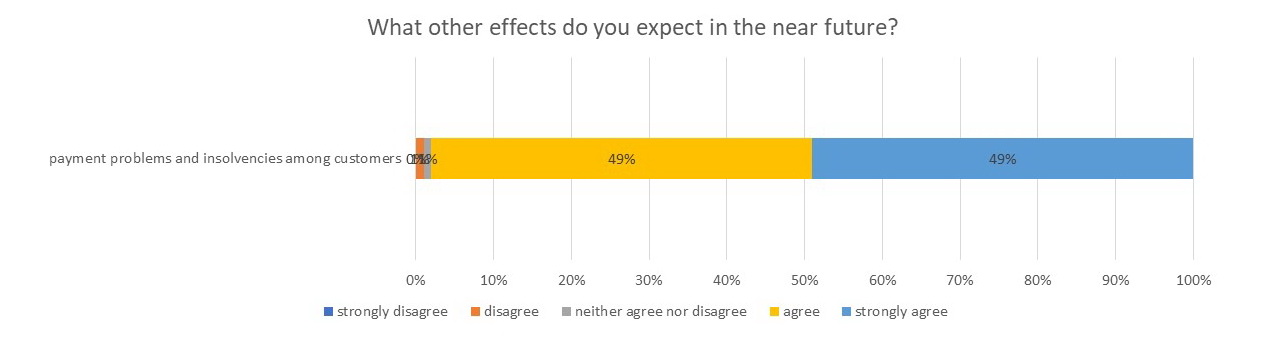

If Creditreform’s forecast on the rising risk of insolvency proves to be true, many companies are likely to run into liquidity problems in the fall. This is also underlined by a member survey the service provider conducted in April 2020.

This makes it all the more important to establish a fit-for-purpose receivables management system in order to remain successful in the market in the long term. The aim is to avoid bad debts and to deal effectively with existing outstanding accounts. Preventive measures, starting right from the drafting of the contract, can also be part of the collection process. This includes, for example, trade credit insurance.

Conclusion

Collecting debts costs time and money. At the same time, this ties up capital which is then not available for new investments. Integrating receivables management into Microsoft Dynamics 365 ERP creates transparency, limits business risks and thus contributes to securing the company’s long-term future.